Are you thinking about investing but unsure where to begin? Maybe you have some extra cash from your side hustle or you’re tired of your savings sitting in a bank account earning very little. Investing can seem like a big, scary jump, especially with all the jargon and market noise, but it’s manageable, even if you’re starting from scratch.

I’m here to share what I’ve learned about starting in South Africa’s unique financial landscape. Let’s get into the basics, keep it straightforward, and help you grow your wealth.

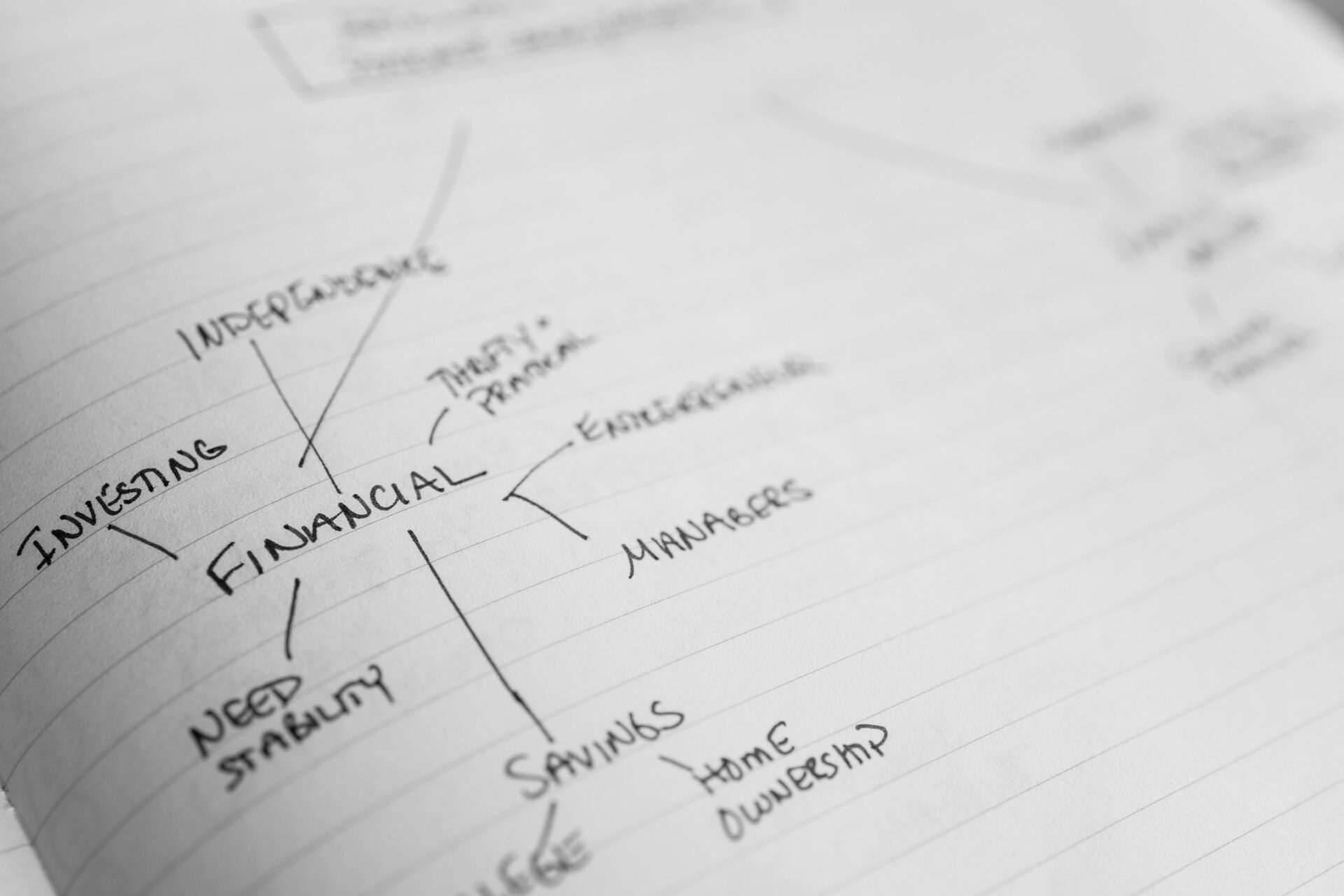

Step 1: Get Your Head in the Game

Before you invest in shares or funds, think about why you’re investing. Are you saving for a car in five years? A house down payment in ten? Or just trying to keep up with inflation, which is sneaky at 5 to 6% a year in South Africa? Your goal affects everything, from how much risk you can take to how long you can leave your money to grow.

Ask yourself:

- How much can I invest each month without overloading my budget? (Even small amounts count!)

- Am I okay with my money being tied up for a few years, or do I need quick access?

- What’s my style—safe and steady, or can I handle some ups and downs?

For example, my friend Candice started with R1,000 a month because she wanted to save for her kid’s university fees in 15 years. Knowing her goal helped her choose investments that could grow over time without making her anxious.

Step 2: Know Your Options

South Africa offers many investment options, but as a beginner, it’s best to keep it simple. Here are three solid starting points that won’t overwhelm you:

Tax-Free Savings Accounts (TFSAs)

These are perfect for newcomers. You can invest up to R36,000 a year with no taxes on the growth from interest, dividends, or capital gains. All banks provide TFSAs with fixed deposits, while life companies offer you equity or shares with higher long term growth AND you can have a BENEFICIARY.

- Why it’s great: No tax, low risk if you choose balanced funds, and you can start with a small amount each month.

- Catch: You can’t replace the R36,000 yearly limit if you withdraw, so plan wisely.

Unit Trusts

These are like a basket of investments (shares, bonds, etc.) managed by professionals. You buy “units” in the fund, and your money grows as the basket grows. For instance, some Balanced Funds have averaged around 10% to 12% annually over ten years. These returns offer real growth as you are beating inflation.

- Why it’s great: It’s diversified, so one poor stock won’t bring you down. You can start with a low amount through a debit order.

- Catch: Fees must always be compared, so read the fine print or ask your advisor. Contact An Advisor

Retirement Annuities

Retirement Annuities (RAs) in South Africa offer several strong financial and tax benefits, especially for high-income earners, professionals, and entrepreneurs. Since interest, dividends and capital gains are not taxed while you remain in an RA, this product remains a great mechanism for investors to save for retirement.

- Why it’s great: You can use RA’s to legally reduce your tax bill by investing into your RA or get SARS to subsidise your investment made. They’re also affordable and easy to buy through an advisor. Contact An Advisor

- Catch: You can start drawing from your RA from age 55 or exceptional circumstances only like emigration or permanent disability .

Step 3: Set Up Your Money Machine

Now it’s time to act. Here are some practical steps to get started:

- Clear Debt First: High-interest debt (like credit cards at 20%) eats into your returns. Pay off anything with more than 10% interest before investing.

- Build an Emergency Fund: Save 3 to 6 months’ worth of expenses (for example, R15,000 if you spend R5,000/month) in a unit trust (8 to 15% returns). This keeps you from needing to dip into your investments when life happens.

- Automate It: Set up a debit order (for example, R1,000/month) for your investment. It’s like paying a bill—you won’t miss what you don’t see.

- Start Small: Even R500/month can build up over time.

Step 4: Dodge the Traps

South Africa is filled with financial noise—crypto enthusiasts and get-rich-quick schemes.

Stay with regulated platforms like those on www.ffreedom.co.za for safety.Contact An Advisor

Step 5: Level Up with a Plan

Once you’re comfortable, think bigger:

- Diversify: Don’t put all your money in one asset class or fund. Spread it across regulated investments, bonds, and maybe some offshore funds for global exposure.

- Reinvest Returns: Allow dividends and interest to compound—don’t cash out early.

- Get Advice: An advisor through www.ffreedom.co.za can help tailor your plan, especially if you’re considering bigger investments like endowments for tax savings (30% interest tax compared to a 45% marginal rate).

The Vibe

Investing in South Africa isn’t just for suits in Sandton. Start small, choose tax-friendly options like TFSAs, RA’s or Unit Trusts, and automate your savings to build wealth without stress. You don’t have to be wealthy—just consistent. As Warren Buffett says, “The stock market is a device for transferring money from the impatient to the patient.” Be the patient one and let your money work for you. Ready to begin? Check out www.ffreedom.co.za for platforms and advisers to guide your journey. Here’s to your first step toward financial freedom!